Creation date: 2009-09-25

Major Trends in Financial Markets

(July 2007)

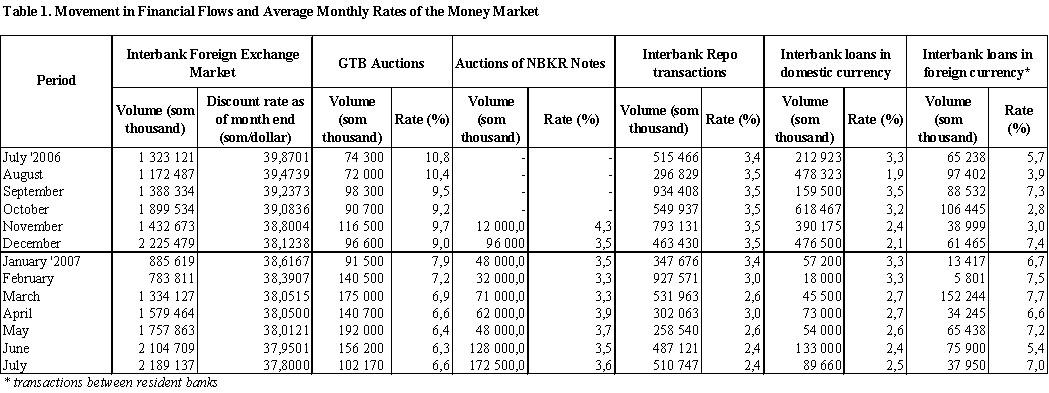

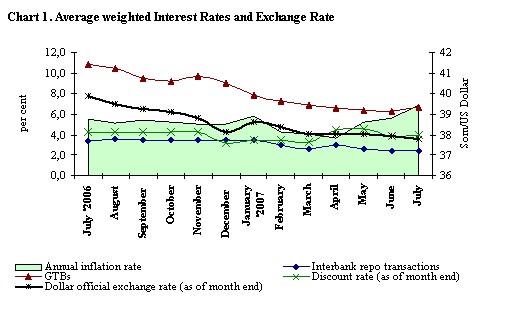

The drop of the liquidity in the bank system in the first half of July caused the decrease in demand in the primary STB market and the increase of yield throughout market segments, first of all, in the market of 6-month STB. However, the activity of commercial banks increased due to the growth of excess reserves in the second half of July, and the demand for bills at the auctions during the last week of the month increased, while the yield of 6-month STB was down. On the whole for the month, the overall weighed average yield of STB increased by 0.3 per cent and made 6.6 per cent. An average weekly amount of filed requests was down by 49.5 per cent and made KGS 42.7 Million, and the sales volume was down by 34.6 per cent, having made KGS 25.5 Million on an average for the week.

A drop of commercial banks’ demand was observed in the NBKR treasury notes market in the reporting month the as well. The average level of demand for the week was down by 31.5 per cent and made KGS 68.6 Million, and the weekly average sales volume increased by 7.8 per cent and made KGS 34.5 Million. On the contrary, the value of notes changed slightly: weighed average yield of 28-day notes did not change and made 4.0 per cent, and the yield of 14-day notes was down by 0.1 per cent, to make 3.0 per cent.

In the inter-bank credit market the demand for borrowed funds in KGS was slightly down in July. The volume of inter-bank credits in national currency in the inter-bank credit market was down by 3.2 per cent and made KGS 600.4 Million. This reduction occurred due to the decrease in credits volume in the segment of ordinary transactions in the national currency by 32.6 per cent, having made KGS 89.7 Million. At the same time, the volume of REPO transactions in the reporting month increased by 4.8 per cent and made KGS 510.7 Million. The weighed average interest rate of REPO transactions remained at the same level of 2.4 per cent, and the average value of ordinary transactions in the national currency increased by 0.1 per cent and made 2.5 per cent.

The excess supply of the foreign exchange remained in the money market in July, which was caused by the inflow of funds from goods and services export, deposits and money transfers of labour migrants. In order to smooth the market situation the National Bank purchased USD at the currency auctions, and the volume of these transactions in the reporting period increased by 7.8 per cent and made USD 37.5 Million. As a whole, for the month the weighed average USD exchange rate at the currency auctions in July was down by 0.4 per cent, having made 37.8 KGS/USD as of the end of the month, USD accounting exchange rate was also down by 0.4 per cent and made KGS/USD 37.8. The USD exchange rate in the exchange offices was down by 0.5 per cent and amounted KGS/USD 37.7865.

The KGS selling rate in the exchange offices depreciated compared to EUR and RUR rates by 1.2 and 0.3 per cent, accordingly, and compared to KZT it became more expensive by 1.6 per cent.

To withdraw the excess KGS liquidity in the bank system, the National Bank declared auctions on STB(r) REPO sale, resulted in reverse REPO-agreements concluded in July with commercial banks for the amount of KGS 420.2 Million. The yield of these transactions varied in the range from 3.55 to 4.0 per cent, depending on the transactions period. In addition, the National Bank conducted transactions on attracting the funds of commercial banks to the NBKR’s deposit accounts with fixed period for the sum of KGS 215.0 Million, at the rate of 1.8 per cent for the period of 7 days and 2.0 per cent for the period of 1 month.